What to Do After a Car Accident

Most drivers never expect to need it, but having a clear action plan before an accident happens can prevent costly mistakes. Shock, adrenaline, and stress cloud judgment in those critical first moments. This makes it easy to miss vital details and forget critical first steps.

In these scenarios, dash cams can make all the difference. According to research by Nextbase, US drivers without video evidence can’t recall 68% of key information following a crash. In fact, no drivers could remember all of the vital information after witnessing an incident, and 44% failed to identify which car was at fault.

But already, 30% of American drivers own a dashcam, and insurers will increasingly prioritize video evidence over subjective accounts. This comprehensive guide walks you through every step after an accident — from emergency safety to correct reporting. At the end, find a free, downloadable accident response checklist for your glove compartment.

Ensure Continued Safety and Check for Injuries

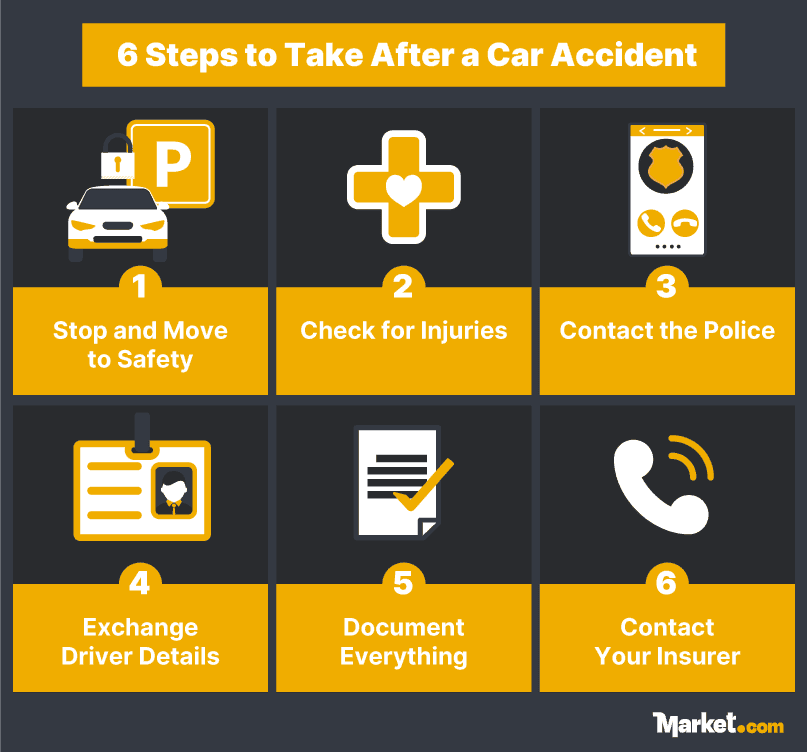

The most important consideration after an accident is the safety of everyone involved. Below, we cover some key steps and best practices.

Stop and Move to Safety

Immediately after an accident, first focus on the most important thing — the safety of you and your passengers. Turn on your hazard lights and, if possible and if no one seems to be seriously injured, move your car out of traffic to avoid congestion and prevent other cars from hitting you.

This is especially important on highways, interstates, and other high-speed roads, where multi-vehicle pile-ups are common. On these roads, move into the breakdown lane as soon as possible.

Not stopping at an accident scene is illegal in all states and constitutes a hit-and-run offense, which can result in criminal charges ranging from misdemeanors to felonies, depending on the severity. Not only that, but leaving an accident scene eliminates your opportunity to gather crucial evidence supporting your version of events.

Check for Injuries

As soon as you’re safe from further injury, check yourself and other passengers for any that may have been sustained in the accident. If necessary, call 911 (or the equivalent emergency number in your country), and begin administering first aid if you’re able. If you’re unable to make the call, ask a bystander.

If any of your passengers are seriously injured, don’t move them unless it’s unsafe to remain in the vehicle. Depending on the person’s injury, moving them can worsen the severity of their wounds.

How Your First Response Can Affect Your Insurance

Refusing to cooperate with your insurer can lead to a denial of your claim. This can include you not reporting the accident promptly or failing to provide any requested information. Not seeking out prompt medical treatment is also a possible red flag, since it may lead insurers to question the legitimacy of your injuries.

For example, in one Florida case, a client was injured in a car accident but didn’t see a doctor until more than 14 days after the crash. When she later filed a claim with her own insurance company, her insurer denied her Personal Injury Protection (PIP) benefits entirely. This meant that she lost up to $10,000 in coverage from her own policy for medical bills, lost wages, and emergency services.

Under Florida’s 14-day PIP rule, you must seek medical care within 14 days of your accident to preserve your right to compensation, even though you’ve been paying premiums for this coverage. Many jurisdictions have similar regulations, so be sure to seek medical care as soon as possible.

Report the Accident

After ensuring everyone’s safety, you’ll typically need to report your accident to law enforcement by calling 911. Depending on your state and the severity of the crash, you may also need to file a separate report with your Department of Motor Vehicles (DMV) — either because police didn’t respond to the scene or because your state requires it regardless.

When to Call 911

Call 911 immediately if your accident involves any of the following:

- Injuries or fatalities, regardless of severity.

- Property damage exceeding your state’s limit (ranging from $500 in Florida to $2,500 in Oregon).

- Vehicles blocking traffic or creating road hazards.

- Damage to public infrastructure like guardrails, traffic signals, or road barriers.

- An uninsured, unlicensed, or impaired driver.

- Threat, aggression, or violence from one of the other involved drivers.

- Hit-and-run situations.

- Vehicles too damaged to be safely driven from the scene.

If you’re uncertain whether your accident meets the reporting threshold, call 911. It’s better to report than risk penalties for failing to do so. In some states, police won’t respond to minor fender-benders. However, even if police don’t come to the scene, you may still be legally required to file a written accident report with your state DMV.

DMV Reporting Requirements

If police respond and file a report, they typically forward it to the DMV automatically. However, you’re still responsible for ensuring the DMV receives a report within your state’s deadline. Even if police were involved, they might not file it on time.

Reporting thresholds and deadlines vary by state:

How to File a DMV Report

To file your DMV accident report, you’ll need to complete your state’s accident report form (e.g., an SR-1 in California or MV-104 in New York). Gather the following information before you begin:

- Date, time, and location of the accident.

- Your driver’s license number and state.

- Your vehicle’s license plate number or VIN.

- Your insurance company name, policy number, and expiration date.

- The other driver’s personal information, driver’s license, vehicle details, and insurance information.

- Description of injuries and property damage.

You can submit your report through multiple methods:

Online: You can complete and submit accident reports digitally on most state DMV websites. You’ll usually need to provide your email address to receive a submission link.

By mail: Download and print the accident report form from your state DMV website, complete it, and mail it to the address listed on the form. It may be worth using certified mail so you have proof of timely submission.

In person: Visit your local DMV office and submit a completed accident report form. Bring all relevant documentation, including insurance information and details about the other parties involved.

Your insurance agent or legal representative can also file the report on your behalf.

Penalties for Not Reporting

Failing to report your accident within the required timeframe can have some serious consequences. Failing to report to the DMV can lead to:

- License suspension: The DMV could suspend your driver’s license until you file the required report, with suspensions typically lasting one year.

- Fines and criminal charges: Depending on the severity of your accident and your state’s laws, you may face fines, points on your license, or even misdemeanor charges in more severe cases.

- Insurance claim denial: Delayed reporting gives your insurer grounds to deny or reduce your claim, and even question whether the accident caused your injuries in the first place.

- Weakened legal position: Without prompt documentation, you’ll struggle to collect supporting evidence like police reports, witness statements, and scene photographs if you later need to sue for damages.

While punishment can vary by state, remaining at the scene but failing to report the accident to police when legally required can lead to:

- Fines: Typically ranging from $100 to $2,000, depending on the state and severity.

- Penalty points: Usually, 5–10 points are added to your driving record.

- License suspension: Possible disqualification from driving for up to 6 months in more serious cases.

- Misdemeanor charges: Classification as a misdemeanor traffic violation, potentially requiring court appearances.

- Imprisonment: Up to 6 months in jail for more serious cases involving significant injury or damage, although this is rare if the driver stayed at the scene.

All of the above are substantially worsened if you commit a hit-and-run, whereby you immediately leave the scene of an accident without stopping. Doing this carries severe legal penalties, involving potentially significant fines and prison time.

Exchange Driver Details, Secure Evidence, and Protect Your Dash Cam Footage

After ensuring everyone’s safety and reporting the accident, gather evidence immediately while details are fresh and the scene is undisturbed.

Exchange Information with Other Drivers

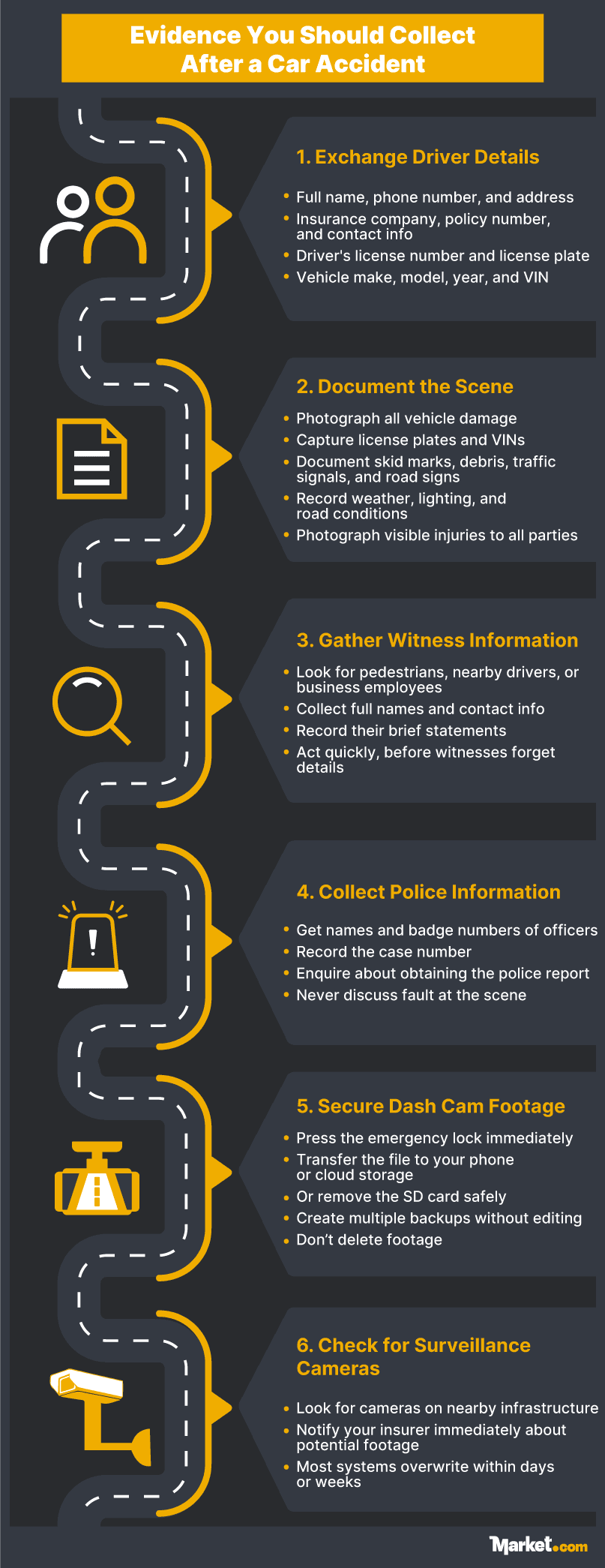

Collect the following from all drivers involved:

- Full name, phone number, and address.

- Insurance company name, policy number, and contact information.

- Driver’s license number and license plate number.

- Vehicle make, model, year, and VIN.

Avoid discussing fault with other drivers. Your insurance adjuster will determine liability based on vehicle inspections, police reports, and supporting documentation.

Document the Scene

Use your phone to capture evidence before vehicles are moved:

- Vehicles: Photograph all damage from multiple angles, including license plates and VINs.

- Accident scene: Capture skid marks, debris, traffic signals, road signs, and any hazards that contributed to the accident.

- Conditions: Document weather, lighting, and road surface conditions.

- Injuries: Photograph any visible injuries to all parties.

Try to keep updated “pre-accident” photos of your vehicle on your phone to demonstrate that damage resulted from the collision rather than pre-existing conditions.

Gather Witness Information

Eyewitnesses provide objective accounts that can corroborate your version of events. Look for pedestrians, other drivers, or people in nearby businesses who may have seen the accident. Collect their full names, contact information, and brief statements about what they observed. Just make sure to act quickly — witnesses forget details as time passes.

Collect Police Information

When police arrive, get the names and badge numbers of all responding officers, the case number, and information about where you can obtain a copy of the relevant police report. Your insurer will likely request this report when you file your claim.

Secure Your Dash Cam Footage

Most dash cams use loop recording that automatically overwrites older footage. To ensure you don’t lose critical footage:

- Press your dash cam’s emergency button to lock the recording.

- Either:

- Transfer the relevant file to your phone (if supported).

- Ensure the video is uploaded to your dashcam’s cloud storage (if supported).

- Remove the SD card to prevent overwriting (turn off the dashcam first to prevent data corruption).

- Create multiple backups on different devices without editing the footage.

- Store the original securely and document each access.

Deliberately altering or destroying dash cam footage constitutes obstruction of justice, which is a federal crime. Even an unintentional deletion can hurt your case.

Dash cam laws: While dash cams are legal nationwide, most states prohibit windshield mounting that obstructs your view — dashboard mounting is recommended instead. Sixteen states, including Arkansas, Delaware, New York, and Tennessee, explicitly ban windshield mounting.

Check for Surveillance Cameras

Look for cameras at nearby businesses, traffic intersections, and residential properties. Notify your insurer immediately about any cameras that may have captured the accident, as most surveillance systems overwrite footage within days or weeks. Having clear video evidence can significantly speed up your claim resolution.

Make the Most of Your Evidence

While having dash evidence is important, you also need to know what to do with it. We cover the basics in the following sections.

File a Claim with Your Insurer

Contact your insurer immediately after your accident — ideally from the scene or through their mobile app — to prevent claim denial or reduced compensation. Most insurance policies require you to report accidents “immediately” or “within a reasonable time.” This is usually a maximum of 30-60 days, however, some policies can be as little as 24–48 hours.

When you file your claim, provide all the evidence you collected:

- Contact and insurance information from all drivers.

- Police report number and officer contact details.

- Photos and videos of vehicles, damage, and the accident scene.

- Witness names and contact information.

- Dash cam or surveillance camera footage.

Your insurer will assign an adjuster to inspect your vehicle and determine fault based on the evidence you provide. Depending on your coverage, you may be reimbursed for repairs or your vehicle’s actual cash value if it’s totaled.

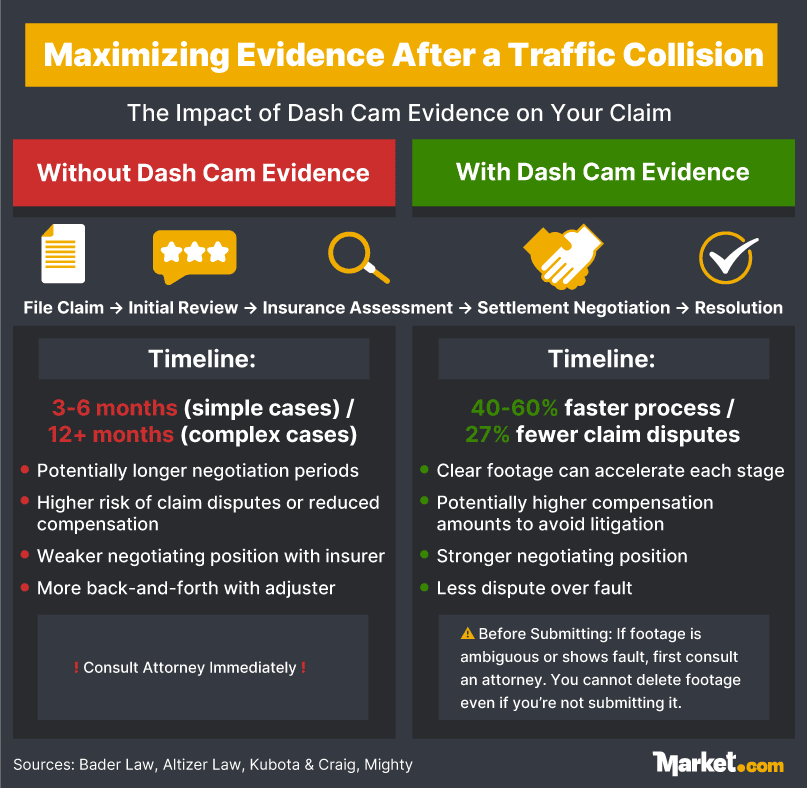

When to Submit Dash Cam Footage

Don’t immediately hand over your dash cam footage to insurers. If the footage clearly shows the other driver at fault, it can significantly strengthen your case. However, if there’s any ambiguity or evidence of your own fault, you can have your attorney evaluate whether submitting it helps or harms your position.

Note that even if you don’t submit the footage, you still can’t delete it. You may be compelled by law enforcement to hand it over. Since not complying is illegal, you’ll want to retain the video for your records.

When dash cam footage is favorable, it can dramatically accelerate your settlement:

- Initial evidence review: 1–2 days.

- Insurance assessment: 7–14 days.

- Settlement negotiation: 30–60 days with clear video evidence.

- Final resolution: Often 2–3 months faster than cases without video.

Many industry insiders state that cases with dash cam footage settle faster and can result in higher compensation amounts. Insurance companies are more likely to offer higher settlements when presented with clear video evidence to avoid costly litigation.

For your footage to be admissible in court, it must meet three criteria:

- Relevance: The video must help establish facts about how the accident occurred and whether traffic laws were violated.

- Reliability: The footage hasn’t been tampered with or altered, with timestamps and chain of custody documented.

- Authenticity: The footage must be verified as genuine and unedited, often through testimony from the dash cam owner.

Submit your footage securely without compression, and importantly, with no editing. Maintain the original file in its native format and create exact copies for submission. Most insurers accept common video formats like MP4, AVI, and MOV.

When to Consult a Lawyer

Contact a car accident attorney immediately after your accident, especially if you’ve sustained injuries. Don’t leave this too long, since statutes of limitations impose strict deadlines for filing lawsuits, typically ranging from 1–3 years depending on your state. If you miss this deadline, you could lose your right to compensation.

Consult an attorney when:

- You’ve sustained serious injuries requiring ongoing medical treatment.

- The other driver disputes fault.

- The insurance company denies your claim or offers inadequate compensation.

- Your accident involves a government vehicle (deadlines are often just 6 months).

- Multiple parties are involved, or liability is unclear.

An attorney can provide legal advice, help navigate the insurance claim process, ensure your claim is filed within required timeframes, and assess potential compensation for medical bills, lost wages, pain and suffering, and other damages. Without legal representation, you risk accepting inadequate settlements or missing critical deadlines that forfeit your right to compensation.

Understanding Claim Timelines

Different types of claims have different deadlines:

- Insurance notification: Immediately to 60 days, depending on your policy.

- Personal injury lawsuits: 1–3 years from the accident date in most states.

- Property damage claims: 3–6 years in most states.

- Wrongful death claims: Typically 2 years from the date of death, not the accident.

- Government entity claims: Often just 6 months to 1 year.

Without dash cam footage, simple cases with minor injuries and clear liability typically settle within 3–6 months, while complex claims involving serious injuries or disputed fault can take 12 months or longer. Dash cam evidence can reduce these timelines by 2–3 months.

FAQs About Car Accidents & Dash Cam Use

What should I do immediately after a car accident?

When should you report a car accident?

How do I report a car accident?

For DMV reporting, check your state’s requirements. Most states require you to submit an accident report form within 5–30 days if there were injuries, fatalities, or property damage exceeding the state threshold. You can file online through your state DMV website, by mail, or in person.

What information should I exchange with the other driver?

How do I file a car insurance claim?

What should I do if my claim is denied?

How do insurance companies determine fault?

Do I need a lawyer for a car accident claim?

What is the statute of limitations for filing a lawsuit?

What evidence should I collect at the scene?

What is a dash cam?

Will a dashcam lower my insurance?

What happens if I don’t exchange information after an accident?

What are common reasons insurance companies deny claims?

Conclusion

Being in a car accident is stressful, but knowing exactly what to do can help prevent panic and enable you to take action. Staying safe, meeting legal requirements, securing evidence, and reporting promptly protect both your physical well-being and financial interests.

A dash cam is invaluable insurance. It provides objective proof that accelerates claim resolution and protects you against fraud.

By following this guide and maintaining detailed documentation, you’re complying with the law and building a strong foundation for fair compensation and faster recovery.